Blog

- API Governance: Framework, Use Cases, and Implementation

- ATM Debit Cards: A Comprehensive Guide

- Customer 360-Degree View with Software Systems

- Why UK Major Banks are Shutting Their Branches

- Ultimate Guide to All-in-One Platforms

- Building a Rewards Software Business

- Mastering Charge Cards: Understanding Benefits and Usage Dynamics

- Leveraging Big Data for Effective Customer Complaint Management

- Unlocking the World of Credit Cards: A Comprehensive Guide for Financial Empowerment

- Unleashing the Power of Financial Instruments

- Unveiling Modern Computing Solution

- Payment Card Essentials: Understanding Types, Features, and Optimized Usage

- High-Growth and Entrepreneurial Organizations

- Your Guide to Smart Credit Management

- Elevating Customer Relationships: Guide to Loyalty Cards

- Mastering Pre-paid Cards: A Comprehensive Guide to Types, Benefits, and Usage

- Unlocking Business Potential: Private Label Cards

- The Art and Science of Penetration Testing

- The Benefits of Subscription Services

- Gift Cards: Types, Benefits, and Selection

- Wealth Management: Secure Your Financial Future

- How Does CNAME Work? Clear Examples and Benefits Explained

- Hedge Funds : Strategies, Impact, and Regulatory Oversight

Exploring Payment Card Specifics: An In-Depth Guide

In the digital age, payment cards stand as pivotal tools in modern financial transactions. They serve as gateways to seamless, secure, and convenient payments worldwide. Understanding the intricacies of payment cards—from their types to specific features—empowers individuals and businesses alike in navigating the financial landscape.

Types of Payment Cards

Credit cards revolutionized the way individuals manage finances. They enable users to borrow funds from a credit issuer to make purchases or fulfill financial obligations. The cardholder can pay the borrowed amount in full by the due date or opt for minimum payments, with interest accruing on the outstanding balance.

Debit cards, on the other hand, facilitate transactions by deducting funds directly from the cardholder's linked bank account. They offer convenience and immediate access to available funds, making them a preferred choice for everyday purchases.

Prepaid cards function similarly to debit cards, but they are not linked to a bank account. Users load a specific amount onto the card, which can be used for transactions until the balance depletes. These cards provide a budgeting tool and often lack the overdraft feature, preventing overspending.

Gift cards stand as versatile tokens of appreciation, offering recipients the freedom to select their preferred items from a specific retailer or brand. They provide a modern solution to the age-old quandary of choosing the perfect gift.

Private label cards are customized payment cards offered by retailers or businesses, often in partnership with financial institutions. These cards carry the branding of the business and are exclusively usable at the issuing retailer or affiliated establishments.

Loyalty cards represent tailored programs designed to reward customer loyalty and incentivize repeat patronage. These cards, offered by businesses across various sectors, aim to enhance customer engagement by providing exclusive benefits, discounts, or rewards.

Charge cards operate differently from traditional credit cards, requiring users to pay the full balance monthly rather than carrying a balance over time. These cards offer spending power with the responsibility of complete payment within the billing cycle.

Key Features and Functionalities

EMV Technology

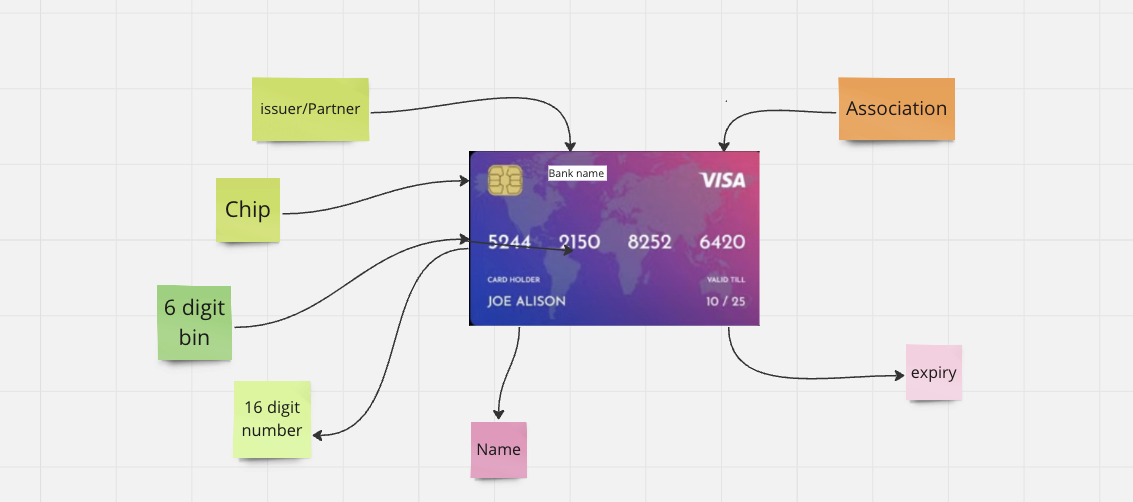

EMV (Europay, Mastercard, Visa) technology represents a global standard for payment card security. EMV cards are equipped with embedded microchips that generate unique transaction codes for each purchase, significantly reducing the risk of counterfeit fraud compared to traditional magnetic stripe cards.

Contactless Payments

Contactless payment capabilities enable swift and secure transactions by tapping the card on a contactless-enabled terminal. This technology enhances transaction speed and convenience, especially for smaller purchases.

Rewards Programs

Many credit cards offer rewards programs that incentivize spending. Cardholders earn points, cashback, or travel miles for qualifying purchases, providing added value for regular card usage.

Security Measures

Payment cards employ various security measures such as PIN (Personal Identification Number), CVV (Card Verification Value), and 3D Secure protocols to safeguard transactions and prevent unauthorized usage.

Choosing the Right Payment Card

Selecting the ideal payment card aligns with individual financial goals and spending habits. Factors to consider include:

- Credit History: For credit cards, a good credit score facilitates access to premium cards with better rewards and benefits.

- Fees and Interest Rates: Understanding annual fees, transaction charges, and interest rates aids in selecting a card that aligns with financial capabilities.

- Rewards and Benefits: Assessing rewards programs and perks offered by different cards helps maximize benefits based on spending patterns.

Optimizing Payment Card Usage: Advanced Insights and Strategies

Advanced Security Measures

In the realm of payment card security, continuous advancements aim to bolster protection against evolving threats. Biometric authentication, such as fingerprint or facial recognition, enhances card security by requiring unique biological identifiers for transactions. Additionally, tokenization replaces sensitive card details with encrypted tokens, further shielding sensitive information from potential breaches.

Global Acceptance and Currency Conversion

One of the key advantages of payment cards is their global acceptance. Major card networks like Visa, Mastercard, and American Express ensure worldwide acceptance, facilitating transactions across borders. Moreover, cards offering dynamic currency conversion enable users to make purchases in local currency while traveling, eliminating the need for manual currency conversions.

Contactless Innovations and Wearables

The evolution of payment technology extends beyond traditional cards. Contactless innovations now encompass wearable devices such as smartwatches and wristbands embedded with payment capabilities. These wearables offer convenience and seamless transactions, expanding the horizons of payment methods beyond conventional cards.

Financial Management Tools and Apps

Many payment card issuers provide financial management tools and dedicated mobile apps to assist users in tracking expenses, setting budgets, and monitoring transactions in real-time. These tools empower cardholders to manage their finances effectively and gain insights into spending patterns.

Tailoring Payment Cards to Lifestyle Needs

Payment cards increasingly offer tailored benefits to cater to diverse lifestyles. Some cards focus on travel perks, offering travel insurance, airport lounge access, and travel-related rewards. Others cater to shopping enthusiasts by providing discounts, exclusive offers, and extended warranties on purchases.

Sustainable and Eco-Friendly Initiatives

In recent years, an increasing number of payment cards have embraced sustainability initiatives. Some issuers collaborate with environmental organizations, pledging to donate a percentage of transactions toward eco-friendly causes, contributing to a more sustainable future through everyday spending.

Conclusion: Navigating the Future of Payment Cards

As payment card technology evolves, it expands its horizons beyond conventional transactions, incorporating advanced security features, innovative payment methods, and personalized benefits. Understanding the nuances of these advancements empowers users to optimize their financial tools for enhanced security, convenience, and rewards.

The future of payment cards lies in a seamless blend of security, innovation, and personalized offerings. Staying abreast of these developments ensures that individuals leverage their payment cards optimally to suit their evolving lifestyle and financial preferences.